Won and led Fidelity’s sustainable investing campaign, generating 100,000+ reach and 20,000+ engagements whilst supporting the firm’s ESG product expansion to mass-market investors.

Strategic challenge: Fidelity was expanding its sustainable investing suite (13 Sustainable Funds, 55+ Article 8 SFDR-classified funds) but faced a perception gap—investors viewed sustainability as divorced from performance. Traditional financial marketing wasn’t resonating with values-conscious younger investors sceptical of “greenwashing.”

Analytical approach: Analysed Fidelity’s existing content performance and competitor benchmarks across financial services in Singapore. Identified performance gaps between traditional finance content (product-focused) vs lifestyle content (values-driven narratives). Tracked metrics, sentiment and demographics to validate strategic approach and optimise content mix.

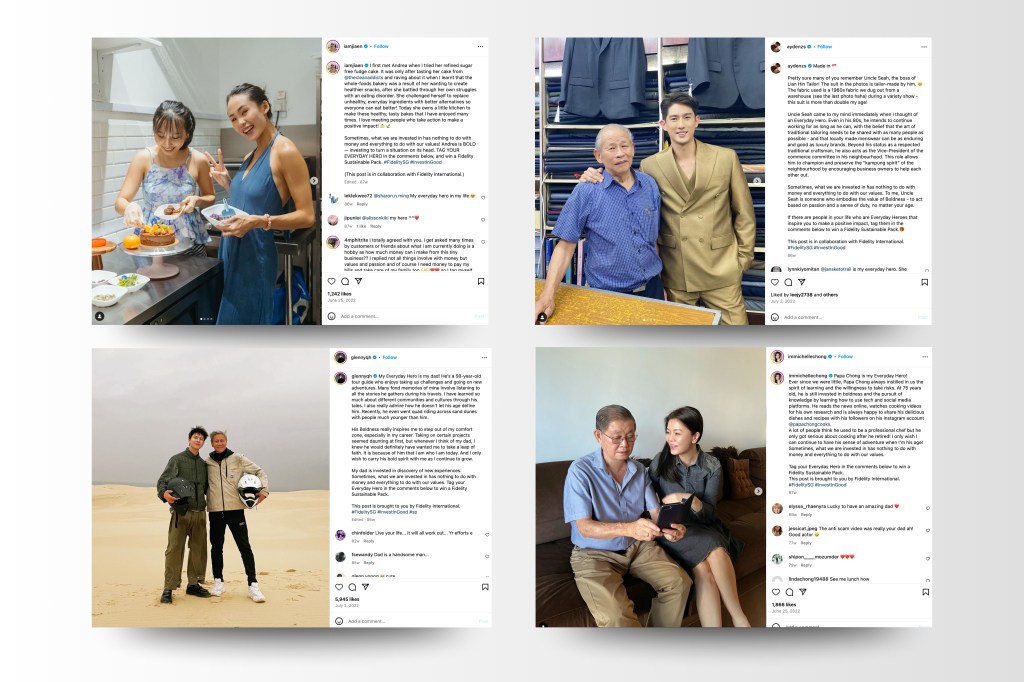

Strategy & execution: Pitched and developed #InvestForGood influencer approach partnering with lifestyle thought leaders like Michelle Chong and Glenn Yong rather than finance experts. Hypothesised that mass market viewed sustainable investing as a values choice first, investment product second—audiences needed relatable narratives connecting personal values (family, legacy, environmental impact) with financial goals. Managed end-to-end campaign including influencer selection, content framework development, creative approvals and performance tracking. Instagram-first approach targeted aspiring affluent audiences (25-45) underserved by traditional wealth communications.

Business impact:

- 20% engagement rate, 4x Singapore financial services social benchmarks

- 100,000+ reach with 20,000+ engagements amongst target demographics

- Positioned Fidelity’s sustainable investing leadership to mass-market audiences beyond institutional clients

- Supported commercial expansion during period when Fidelity won ‘Fund House of the Year – Singapore’ recognition

Context: Campaign supported Fidelity International’s broader sustainable investing leadership positioning, including global engagements with 1,100+ companies on ESG, net-zero by 2030 commitments and Asia-focused stewardship operations led from Singapore.